Recognizing Animals Risk Defense (LRP) Insurance: A Comprehensive Overview

Browsing the realm of animals danger defense (LRP) insurance coverage can be a complex undertaking for several in the farming market. From exactly how LRP insurance policy operates to the various coverage choices offered, there is much to reveal in this thorough guide that could possibly form the method livestock manufacturers approach danger monitoring in their businesses.

Just How LRP Insurance Functions

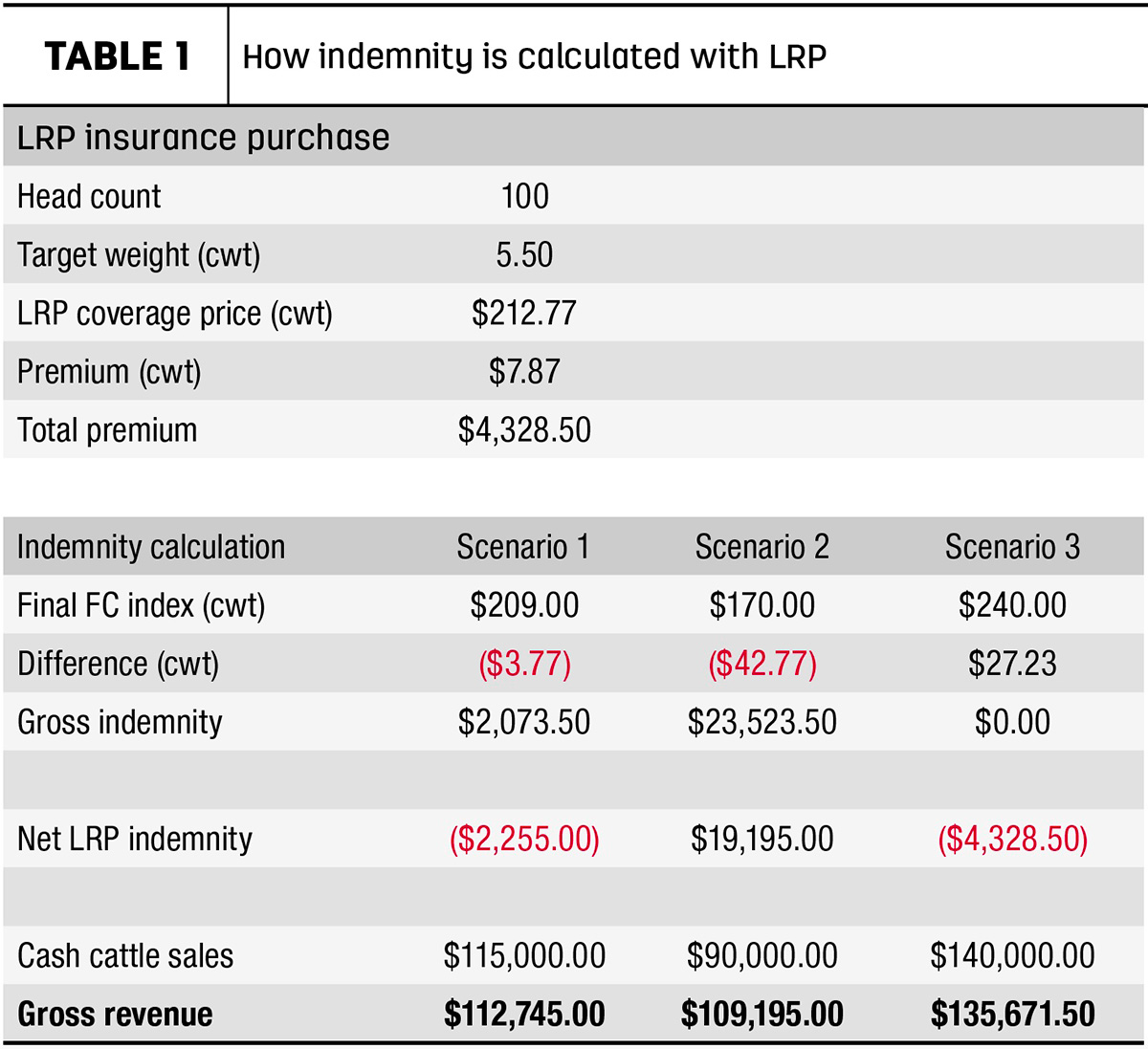

Periodically, understanding the auto mechanics of Animals Threat Defense (LRP) insurance coverage can be intricate, yet breaking down how it works can supply clearness for farmers and herdsmans. LRP insurance coverage is a danger administration device made to protect livestock producers against unexpected price declines. It's essential to note that LRP insurance policy is not a revenue guarantee; rather, it concentrates exclusively on price danger protection.

Qualification and Protection Options

When it comes to protection options, LRP insurance supplies manufacturers the flexibility to select the protection degree, insurance coverage period, and recommendations that finest suit their danger administration requirements. By understanding the qualification requirements and coverage choices offered, livestock producers can make educated decisions to handle threat efficiently.

Advantages And Disadvantages of LRP Insurance Coverage

When reviewing Animals Risk Security (LRP) insurance policy, it is crucial for animals producers to consider the drawbacks and advantages fundamental in this threat monitoring tool.

One of the key advantages of LRP insurance coverage is its capability to offer security against a decrease in livestock prices. This can help guard manufacturers from economic losses resulting from market changes. In addition, LRP insurance supplies a degree of flexibility, enabling producers to customize protection levels and plan durations to fit their particular needs. By securing a guaranteed cost for their livestock, manufacturers can better take care of danger and plan for the future.

One restriction of LRP insurance coverage is that it does not shield against all types of risks, such as illness outbreaks or all-natural catastrophes. It is critical for producers to very carefully examine their private danger exposure and monetary situation to identify if LRP insurance policy is the appropriate threat management device for their procedure.

Understanding LRP Insurance Coverage Premiums

Tips for Making The Most Of LRP Conveniences

Making the most of the benefits of Livestock Threat Protection (LRP) insurance policy needs strategic planning and positive threat administration - Bagley Risk Management. To take advantage of your LRP insurance coverage, think about the adhering to pointers:

Routinely Analyze Market Problems: Keep notified concerning market patterns and cost variations in the animals sector. By checking these factors, you can make enlightened choices concerning when to purchase LRP insurance coverage to secure versus possible losses.

Set Realistic Protection Levels: When picking insurance coverage levels, consider your production expenses, market price of animals, and possible threats - Bagley Risk Management. Setting sensible protection degrees makes sure that you are sufficiently safeguarded without paying too much for unneeded insurance policy

Expand Your Insurance Coverage: As opposed to relying solely on LRP insurance coverage, you can find out more consider expanding your danger management strategies. Integrating LRP with various other risk administration devices such as futures contracts or choices can give comprehensive coverage versus market uncertainties.

Evaluation and Readjust Protection Routinely: As market problems transform, regularly review your LRP insurance coverage to guarantee it lines up with your present risk direct exposure. Changing insurance coverage degrees and timing of purchases can assist maximize your threat security approach. By following these tips, you can make best use of the benefits of LRP insurance and safeguard your animals operation against unexpected risks.

Verdict

In conclusion, animals danger security (LRP) insurance coverage is an important tool for farmers to take care of the monetary dangers connected with their animals operations. By recognizing how LRP functions, eligibility and insurance coverage alternatives, in addition to the pros and cons of this insurance policy, farmers can make educated choices to shield their source of incomes. By meticulously taking into consideration LRP premiums and carrying out strategies to optimize benefits, farmers can alleviate potential losses and make certain the sustainability of their procedures.

Animals manufacturers interested in official statement obtaining Livestock Risk Protection (LRP) insurance can explore a variety of qualification criteria and protection choices tailored to their specific livestock procedures.When it comes to insurance coverage choices, LRP insurance coverage supplies manufacturers the flexibility to choose the coverage level, protection period, and endorsements that best match their danger monitoring requirements.To understand the details of Animals Threat Defense (LRP) insurance completely, understanding the aspects influencing LRP insurance premiums is important. LRP insurance policy premiums are determined by various aspects, including the protection degree picked, the expected rate of animals at the end of the insurance coverage period, the kind of animals being insured, and the length of the coverage period.Testimonial and Adjust Insurance Coverage Frequently: As market conditions alter, occasionally review your LRP insurance coverage to ensure it lines up with your current risk direct exposure.